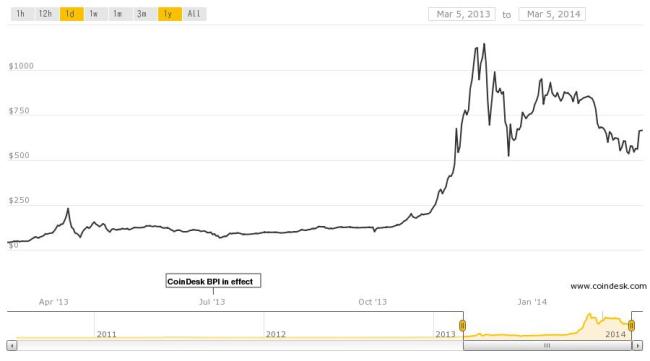

Bitcoin has gained so many controversies all over the world. In the last few months, the popularity of Bitcoin has skyrocketed due to its hundreds of times increase in price. Bitcoin made headlines on November 29, 2013 as the price of a single coin hit an all-time high, recorded at $1,242 per coin compare to the first time it introduced in 2009 which nearly had no value.

Since Bitcoin has attracted a lot of attention, a lot of people are arguing over it now. There are debates between economic schools, between politicians, between programmers. Some people are smart, some are misinformed. Some say it’s a digital gold, some say a currency, other say they’re just like tulips. Some people say it will change the world, some say it’s just a fad. Well, I have my own opinion about it.

Just to make sure we are in the same page, here’s the explanation about what Bitcoin is and how it works. Bitcoin is the first digital currency that can be used in peer-to-peer exchange system, but certainly not the last. I could say that it is a fascinating idea with extremely controversial subtexts. The transaction is not backed by any central bank; it is traded on a number of exchanges privately and generated by a process called mining. Theoretically, it is possible for all computers across the world to run the software and locate Bitcoin by solving an algorithm. The Bitcoin owner has a virtual wallet and a transaction can be made through the use of key identification, but not the identity of the user.

It seems that Bitcoin can solve many problems from which our current currencies suffer while also create problems that consumers, bankers and economists have never had to deal with before.

Bitcoin Upsides

Low Inflation Risk

Unlike in traditional paper economies where governments can print as much currency as they need, the Bitcoin system is designed to be finite. Growth of the Bitcoin money supply is determined by the Bitcoin protocol, in this way inflation is kept in check. Currently there are 12 million Bitcoins in circulation and the rate of new Bitcoins will be halved every four years until the maximum total supply of 21 million Bitcoins which expected to be happened in 2140.

Efficiency

Since there are no middlemen involved in transaction and it is not tied to any country or subject to regulation, the transaction fee of Bitcoin is really low. The cost is so much cheaper compare to credit cards (3% of transaction value), PayPal and other online payment systems. In addition, remember that Bitcoin is digital. With a virtual wallet, money is easy to store and carry. People can send 1000 Bitcoins or 10 million Bitcoins or even 0.000001 Bitcoins easily by a click of a button, doesn’t matter whether one person is in Jakarta and the other is all the way in New York.

No Government Dependence

As Bitcoin is a global virtual currency, it doesn’t depend on government collapsing or re-emerging. Although in the theory money is not a political product, in the reality most of all currencies created by human beings will become political at some point.

Niche Market in Global Financial System

Bitcoin fits an important niche in global financial system, there are still a lot of people who can’t access the global financial system but they can access Bitcoins. It is an attractive investment because it is a store of wealth, in a completely free market. Some people buy Bitcoins hoping that their value will go up. There is still room for improvement but the Bitcoin is still in its infancy.

Untraceable

The final upside is the first downside. Bitcoins can be used to buy merchandise anonymously. No one knows who you are and the Bitcoins can be sent to purchase or sell with genuine anonymity. Furthermore, unless the owner of Bitcoin tells someone about their Bitcoin wealth and their passwords, there is no way for others to know how much Bitcoin wealth you have.

Bitcoin Downsides

Untraceable

With the characteristic of untraceability, Bitcoin can be used for money laundering and for transacting illegal goods such as drugs, guns and other items.

Lost Bitcoins are Lost

If people lose their Bitcoins, they will have lost them for good. There is no system yet to recover the lost or stolen ones.

Price Volatility

Bitcoin markets are not for the faint of heart as the prices are extremely volatile. As of this writing, Bitcoin price is about $660, it was ranging anywhere between $500 and $1200 per Bitcoin in the last two months. Each day brings a different price or so it seems since price can easily fluctuate 2% to 5% within minutes for no apparent reasons. This leads to a major challenge: Bitcoin’s value is not stable. It has fluctuated wildly, which makes it not suitable as a long-term currency. These fluctuations are often due to speculation which happens because the supply is fixed (only 21 million will be mined) and the demand is erratic.

Speculative Bubble

Bitcoin can be traded as an investment by speculators who expect growth in popularity and value. The high risk of engaging in speculation has gone beyond a potential loss of Bitcoin value since it becomes vulnerable to theft and hacking as well. Two lead Bitcoin software developers, Gavin Andersen and Mike Hearn had warned that bubbles may occur. One financial journalist has correctly predicted one of the bubbles which burst in April 2013.

Threat from Government Intervention

In addition to these downsides, Bitcoin is also expected to have serious problems with governments. Under the best circumstances, Bitcoin is expected to be immune from government intervention, especially regarding to its legality. However, when the governments begin issuing rules against Bitcoin, its market value will be plummeted.

Based on the upsides and the downsides, I could say that Bitcoin is not ready to be a currency. Even though others who mistrust their national currencies and central banks have seen Bitcoin as a safe haven from inflation, capital controls and international sanctions, the volatility of its value limits Bitcoin to act as a currency. However, this doesn’t prevent Bitcoin to be used as a medium of exchange. There is no cheaper way to pay for goods internationally than Bitcoin. As consumers continue to engage in digital marketplaces, Bitcoin becomes an advantageous option. There are also thousands of Brick-and-Mortar businesses, up by 300% since November 2013 which are now accepting Bitcoin. With low fees and its efficiency, Bitcoin has potential to address some of the biggest issues in our financial system today, especially when it comes to micropayments.

It will be very interesting to see what the future of Bitcoin is. Stay tuned!